- Matt Bodnar

- Posts

- Finding Hidden Gems: A Framework for Evaluating Deals

Finding Hidden Gems: A Framework for Evaluating Deals

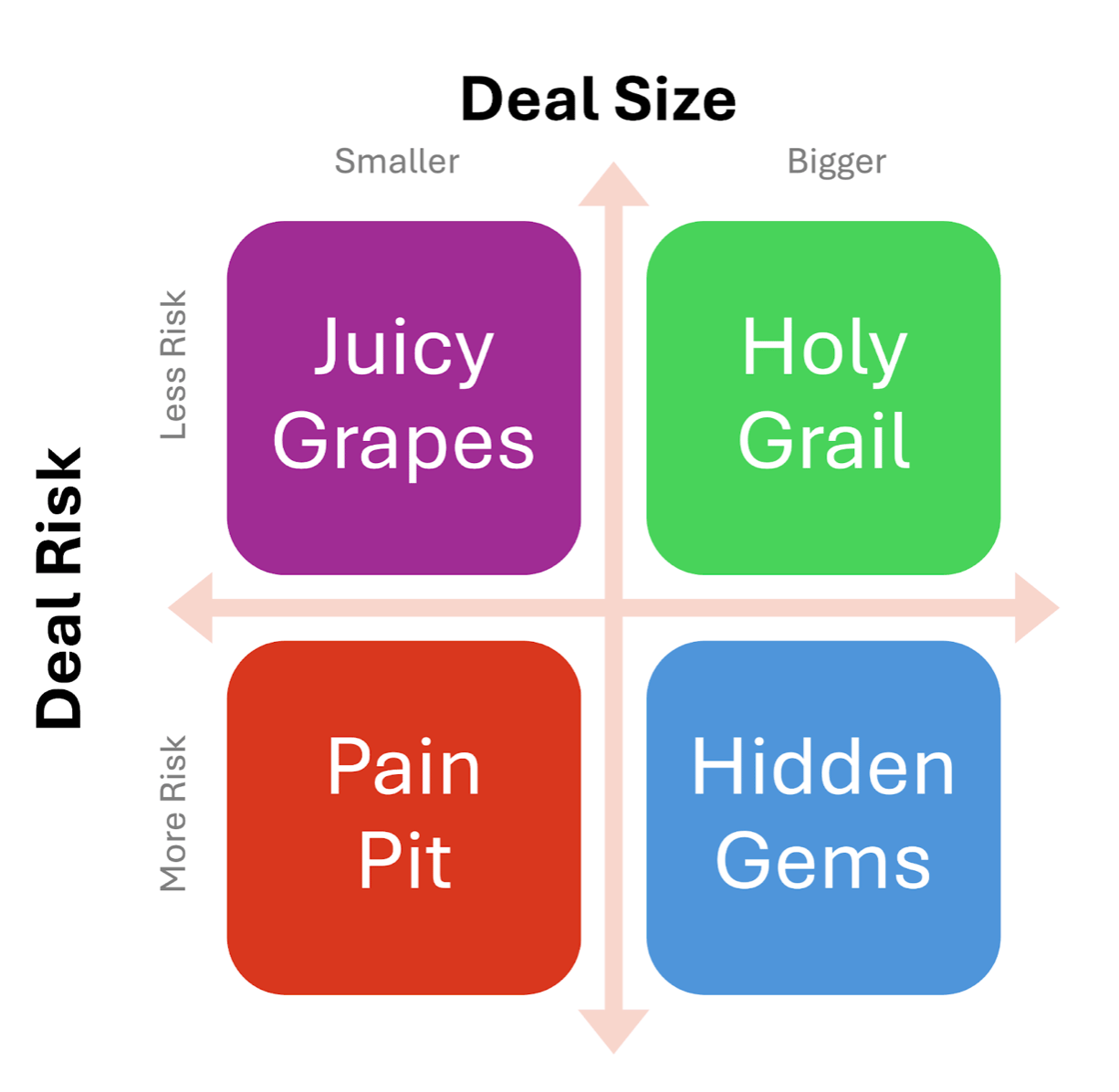

When it comes to analyzing potential acquisitions, understanding the relationship between deal size and risk can unlock opportunities—and steer you clear of costly mistakes. Inspired by insights from Brad Jacobs’ How to Make a Few Billion Dollars and my personal experiences, here’s a practical framework for categorizing deals into four buckets.

The Four Deal Quadrants

Holy Grails: Big Deals, Low Risk

These are the dream deals—large businesses with minimal risk. Everyone wants them, so they’re rare and fiercely competitive. If you find one, grab it—but don’t count on it as your main strategy.The Pain Pit: Small Deals, High Risk

Avoid these at all costs. Small businesses with big problems consume your time and energy without delivering meaningful returns. Been there, done that—never again.Juicy Grapes: Small Deals, Low Risk

These smaller, well-run businesses can add value, but they rarely scale or move the needle significantly. They’re like a snack: enjoyable but not a full meal. A few juicy grapes in your portfolio can be great, but don’t overcommit.Hidden Gems: Big Deals, High Risk (but Solvable)

This is where the magic happens. Larger deals with fixable challenges offer some of the best opportunities for value creation. You’re not paying a premium for “perfection” but instead buying potential—problems you can solve through your expertise, resources, or strategic integration.

Why Hidden Gems Are Worth Hunting For

Hidden gems often come with solvable issues like operational inefficiencies, outdated strategies, or untapped market potential. If you have the skills or the right infrastructure to address these challenges, you can acquire these businesses at a discount and unlock massive upside.

Here’s the key: not all problems are fixable. Avoid businesses with structural flaws, like declining industries or broken products. But if the challenges are manageable, these deals can be really strong.

Tailoring the Strategy to Your Scale

Size is relative. For some, a “small deal” might be $100k; for others, it’s $10M. The same goes for “big deals.” The framework adapts to your unique goals and resources. Focus on identifying opportunities within your range, staying out of the pain pit, and hunting for hidden gems.

Key Takeaway

Think beyond the obvious. By focusing on hidden gems—bigger deals with solvable risks—you can create outsized value. It’s about finding opportunities where others only see problems and applying your skills to unlock their full potential.

Ready to start hunting for your own hidden gems? Let’s connect and strategize!

-Matt

Get Your Free, Personalized M&A Roadmap

Ready to buy a business but not sure what steps to take next? Don’t go it alone.

Our Complimentary M&A Roadmap is designed specifically for aspiring business buyers like you. This custom-tailored plan will give you clarity on your next moves, actionable steps, and expert insights to get you closer to owning the business you’ve been dreaming about.

Let’s make it happen.

Click below to book a free call with my team and get your personalized roadmap. The first step to owning a business starts here.